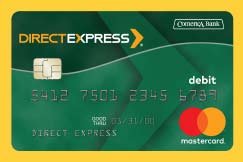

In 2008, the U.S. Department of the Treasury and Comerica Bank launched the Direct Express® Debit Mastercard® to give recipients of Social Security, Supplemental Security Income (SSI), and Veterans benefits a safe, reliable, convenient, and low-cost alternative to receiving their benefit payments via paper checks. For millions of unbanked benefit recipients, these check payments were difficult to manage and costly to convert into cash (see “Direct Express Saves Americans $150 Million Annually”).

Since then, a number of other disbursements have become available via the Direct Express® card (see “A Growing Program”), and the card program itself has evolved to embrace technological innovations that provide enhanced capabilities, convenience, and safety to cardholders. Each feature introduced to the program over these years was based on insights derived from rigorous research, such as the annual cardholder survey (conducted by a third-party survey research firm), and our years of experience serving this unique customer base.

See below for a timeline of innovations and other program milestones.

DIRECT EXPRESS® TIMELINE

| 2008

Direct Express® Launched More than a decade and a half ago, the U.S. Department of the Treasury was faced with the challenge of phasing out paper checks in favor of an electronic payment option, per a congressional mandate. However, millions of Americans did not have bank accounts or a means of receiving electronic payments. This challenge was overcome through the Direct Express® Prepaid Debit Mastercard®, which replaced paper checks for millions of Americans, while also reducing cost to taxpayers. |

| 2009

Cardholder Survey Mastercard® formed an exclusive relationship with KRC Research to perform the first of what would become the only large-scale annual survey of participants in a government benefit card program. The insights about cardholder behavior, preferences, and circumstances obtained from these annual surveys have informed every significant program development and innovation since. |

| 2011

Direct Mail Campaign In late 2011, approximately 800,000 brochures were mailed to cardholders (reaching nearly half of all cardholders at that time) focused on providing simple, actionable guidance on key features of the card program, including bill payment, using the card in stores, cashback features, and more. This mailing resulted in a dramatic improvement in awareness of lesser-known card features, such as free ATM access, cashback features at Point-of-Sale locations, and the availability of text message alerts. |

| 2013

Financial Education In order to engage beneficiaries and improve their financial health, Comerica Bank and Mastercard partnered with PayPerks, a financial learning company that combined short learning modules (available in both English and Spanish) with a sweepstakes-based rewards program. Beneficiaries were able to access the PayPerks platform from any computer or mobile device with internet access. The combination of education and rewards was intended to help beneficiaries learn how to access all the valuable features and benefits of their Direct Express® cards, in ways that minimized fees and maximized convenience. This program was later replaced by the Direct Express Financial Education Center (DEFEC)(See below). |

| 2013

Instructional Video Recognizing the need to further improve cardholders’ awareness of how they could use their Direct Express® cards to their best advantage, Mastercard® produced a three-minute video showing a “day in the life” of a Direct Express® cardholder, showing how Direct Express® cards are used throughout the day to make purchases, pay bills, get cash back at the grocery store, etc. The video was played in Social Security Administration offices where most cardholders apply for the program. |

| 2015

Direct Express® Mobile App (DX℠) In 2014, only 40 percent of Direct Express® cardholders owned smartphones. However, the Direct Express® Annual Cardholder Survey indicated that at the rate smartphone ownership was growing, the majority of cardholders would have them within just a few years. Recognizing the opportunity to deliver additional value to cardholders, the Direct Express® mobile app (DX℠) was made available in August 2015. After registering for the app, cardholders were able to choose a PIN code for security purposes, and can then check their balances, view transaction details, confirm pending deposits, locate nearby ATMs, and pinpoint free cash-back locations. Since the launch, 90 percent of users report accessing the app every month. 42 percent of users say they check their account balances on the app six or more times a month. |

| 2016

Direct Express® Cash Access In 2016, Comerica launched a new cash-out option for Direct Express® cardholders at the world’s largest retailer, Walmart. Recognizing that Walmart had thousands of convenient locations across the United States where many Direct Express® cardholders were already shopping, Comerica established a program allowing Direct Express® cardholders to withdraw cash, including their full account balance (up to $1000) in one easy transaction. |

| 2016

Chip Card Technology In 2016, Direct Express® integrated the “EMV” (Europay, Mastercard, Visa) chip into its cards, technology considered the global standard in card protection. EMV aims to prevent counterfeiting, making it more difficult for criminals to “clone” cards. Direct Express® was the first major government benefit card program in America to migrate to chip cards, blazing a trail for programs that followed, including many state unemployment and child support card programs such as the Supplemental Nutrition Assistance Program (SNAP) and the Electronic Benefits Transfer (EBT) program. |

| 2018

10 Millionth Education Tutorial In April 2018, PayPerks delivered 10 million financial capability educational tutorials, which coincided with National Financial Capability Month. Educational tutorials continued to empower cardholders by providing the knowledge and tools they need to participate fully in the digital economy. PayPerks was later replaced by the Direct Express Financial Education Center (DEFEC)(See below). |

| 2020

Enhanced DX℠ Mobile App In Spring 2020, a new version of the mobile app was made available to new cardholders. The new Direct Express® DX℠ mobile app brought with it a new card summary screen, an easy app-based option for users to change their PIN, the ability to generate an account statement andto make card-to-bank transfers. It also offered enhanced security and fraud prevention with the functionality to temporarily block and unblock a card. |

| 2021

Direct Express Financial Education Center On March 22, 2021, the Direct Express® program launched the new Direct Express® Financial Education Center. This provides cardholders with the tools and knowledge necessary to make informed financial decisions. This valuable resource offers a library of topics organized into short micro-learning modules within broader topic areas such as budgeting and saving, privacy and security, and elder financial fraud prevention. They are designed with engaging content and interactive exercises that allow cardholders to practice what they learn. |

| 2021

Biometric Access In December 2021, Biometric Access was added to the Direct Express® DX℠ mobile app, allowing cardholders to access their card account through fingerprint or facial recognition, instead of a typed password. This new feature was developed after feedback from DX℠ users, garnered from the annual Direct Express® Cardholder Satisfaction Survey. |

| 2023

One Million Cardholders Using the Mobile App In 2023, a milestone was reached as the millionth cardholder downloaded and activated the Direct Express® DX℠ mobile app on their smart device. |

| 2024

Digital Wallets Comerica is currently working with Mastercard® to enable tokenization of Direct Express®card accounts. This is the process that enables card credentials to be securely stored and used in digital wallets such as Google Wallet® and Apple Pay®. Tokenization replaces the sixteen-digit card number with a secure, encrypted digital “token” that is stored in the wallet. Transactions using the wallet never expose the actual card account number, using this secure token instead. This development will offer additional convenience as Direct Express® cardholders will be able to “tap to pay” using their mobile device wallets, as well as benefit from heightened security. |

SOURCE: Direct Express®

![“I do a lot of shopping online….” [VIDEO]](https://directexpress.info/wp-content/uploads/2024/07/Untitled-3-500x383.jpg)

![“I depend on it….” [VIDEO]](https://directexpress.info/wp-content/uploads/2024/06/Untitled-3-500x383.jpg)

![“Having the card is a lifesaver….” [VIDEO]](https://directexpress.info/wp-content/uploads/2024/05/Gerard-500x383.jpg)