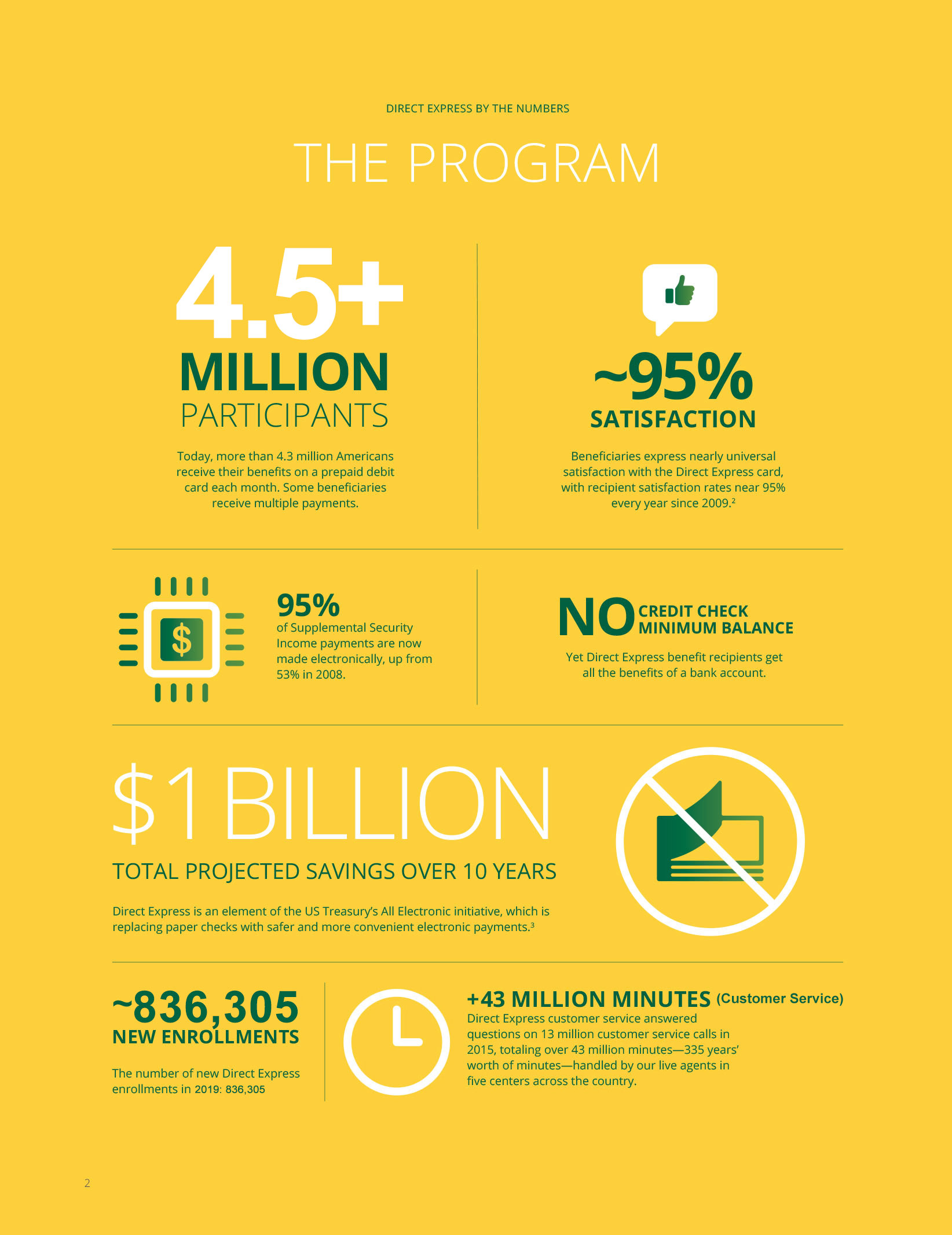

Over a decade ago, the U.S. Department of the Treasury’s Bureau of the Fiscal Service (Fiscal Service) was faced with the challenge of phasing out paper checks in favor of an electronic payment option, per a congressional mandate. However, millions of Americans did not have bank accounts or a means of getting an electronic payment. How this challenge was overcome is a story of successful government. The Direct Express® Prepaid Debit Mastercard® has replaced costly paper checks for 3.6 million active cardholders, while also reducing cost to taxpayers.

Each year, billions of payment transactions are processed by Fiscal Service, approximately 95% of these are electronic. In the past, the paper processes associated with these transactions could be slow, unsecure, and expensive. For every paper check that is converted to an electronic payment the American taxpayer saves about $1. This translates to millions of dollars in cost savings since the program began about 14 years ago. Equally important is the fact that electronic payments provide beneficiaries with a safer, more reliable and convenient way to receive their payments, normalizing the way that beneficiaries handle their money, through features similar to a traditional bank account.

In 2008, the Treasury’s Fiscal Service and Comerica Bank launched the Direct Express® Prepaid Debit Mastercard® to give Social Security, Supplemental Security Income (SSI) and Veteran beneficiaries a safer, reliable, convenient, and low-cost alternative to paper checks. Since then, a number of other disbursements can be accessed via the Direct Express® card (see “A Growing Program”).

In the years since its launch, Direct Express® has become the largest government prepaid card program for federal benefit recipients.