April is Financial Literacy Month, making it a natural time to talk about PayPerks, the optional educational and rewards program available for Direct Express® cardholders since 2013. In the 6 years since PayPerks has been available for Direct Express®, cardholders have completed nearly 13 million educational tutorials from the PayPerks curriculum, learning about the ways to best use their cards, manage their funds, maximize their benefits, and stay safe online, among many other topics.

About PayPerks for Direct Express®

PayPerks is a fintech startup that was founded in New York City in 2010 to address a growing concern: prepaid debit cards such as Direct Express® were providing significant benefit to individuals without access to a bank account, yet some consumers were unfamiliar, unaware or unsure of how to use them or take full advantages of the features of the card.

The PayPerks Curriculum

The PayPerks approach to educating consumers about the cards involves fun and engaging, bite-sized tutorials, paired with sweepstakes-based, small dollar, cash rewards.

The educational content available through PayPerks for Direct Express® cardholders covers a wide range of topics across 150+ different tutorials. These range from card basics, to multi-part lessons on subjects such as budgeting and savings, privacy and security, and reducing unnecessary fees.

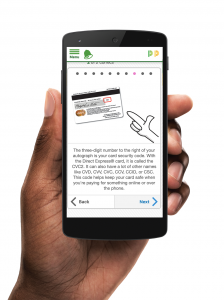

Direct Express® cardholders have a wide range of backgrounds and prior experiences. Many have never had a bank account before and others have only ever used cash and checks. To accommodate everyone, PayPerks lessons start with the fundamentals, with lessons such as “Anatomy of My Card”, a tutorial that explains what the different numbers on the face and back of the card are meant for, in a straightforward and helpful way.

It is important to start with fundamentals because, for example, without understanding what a CVV/CV2 code is and where to find it on one’s card, it would be hard to pay bills online, a great advantage of Direct Express®. Some first-time cardholders have also reported being nervous about the expiration date on their card, not understanding that when the date arrived, they would be automatically sent a new card. Supplying this knowledge eliminated a worry and also provided an opportunity to educate cardholders about the importance of keeping their address up-to-date on their card account as they moved.

It is important to start with fundamentals because, for example, without understanding what a CVV/CV2 code is and where to find it on one’s card, it would be hard to pay bills online, a great advantage of Direct Express®. Some first-time cardholders have also reported being nervous about the expiration date on their card, not understanding that when the date arrived, they would be automatically sent a new card. Supplying this knowledge eliminated a worry and also provided an opportunity to educate cardholders about the importance of keeping their address up-to-date on their card account as they moved.

The curriculum available in PayPerks for Direct Express® is adapted and expanded for the specific needs of Direct Express® cardholders. A new six-module series was launched earlier this year for cardholders receiving Social Security disability benefits, covering information on the ways they can save, re-train for different jobs, and take advantage of other available government resources. Another series of modules launched last year covers topics relevant to veterans, another large constituency of cardholders. PayPerks also solicits feedback from cardholders about what they would like to learn, and this feedback often results in creation of new modules about many topics relevant to Direct Express® cardholders.

Cardholder Impact

The lessons available through PayPerks for Direct Express® have a real-world impact for the cardholder beyond just the accumulation of knowledge and skills or a savings reserve. Cardholders report that learning about their card, and financial capability skills in general, allows them to get the best out of their card, creating a sense of security, reducing unnecessary anxiety, and increasing self-esteem and confidence. Cardholders report that they are grateful the program exists not only for themselves, but also for other cardholders on the program who they know also need help.

In future blog posts about PayPerks, we will dive deeper into specific cardholder feedback about the lessons learned from the curriculum and how that has impacted their daily lives.

SOURCE: PayPerks