As part of our annual survey of cardholders Direct Express® collects demographic and other information about who we serve, where they live and how they use their card. This data, which is aggregated and anonymized, is used to develop insights that can drive innovation and ensure that the Direct Express® card program is improved for the people that use it.

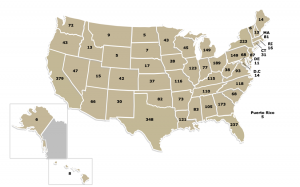

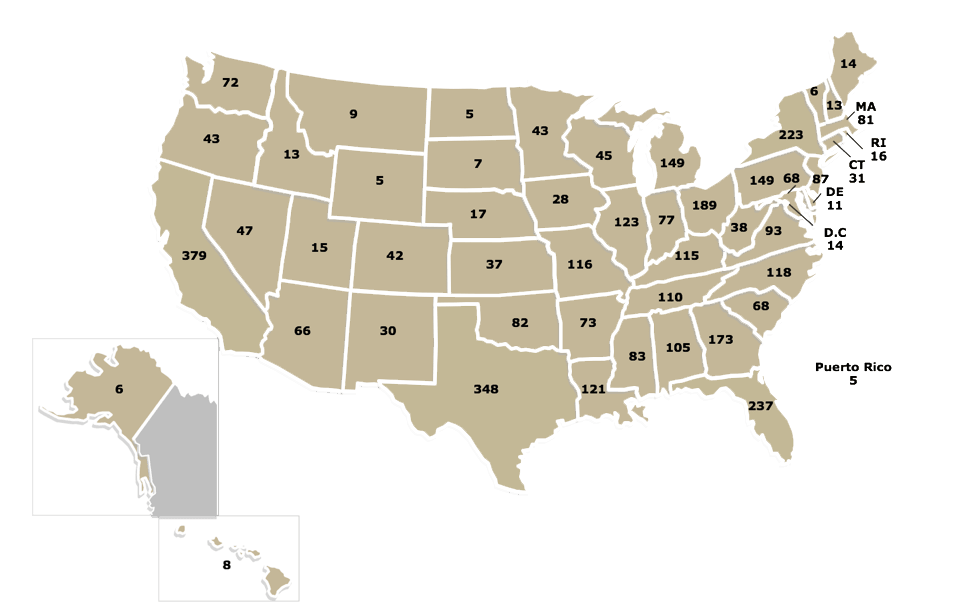

1. Cardholders by State

Direct Express® has cardholders in all 50 states, the District of Columbia and in major territories such as Puerto Rico. There are 4.5 million cardholders in total. The largest number of cardholders lives in California (379,000) and the fewest in the US Virgin Islands (325).

Fig. 1. Cardholders by State (in Thousands)

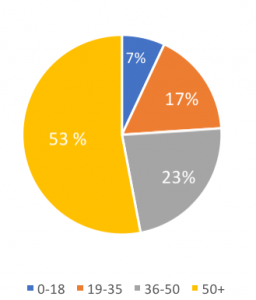

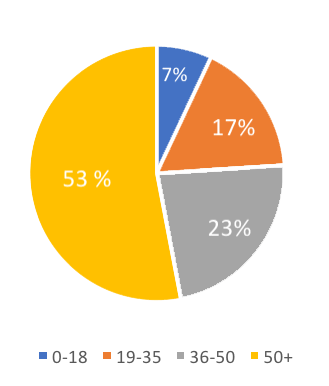

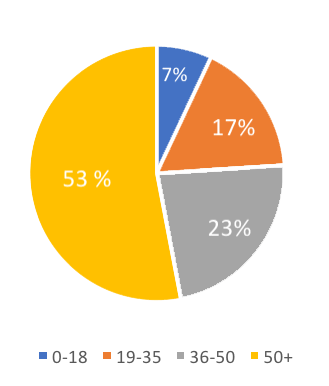

2. Cardholders by Age

More than half of cardholders are over 50 years old, with only 7 percent under the age of 18.

Fig 2. Cardholders by Age

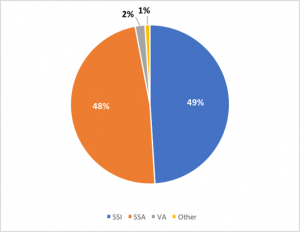

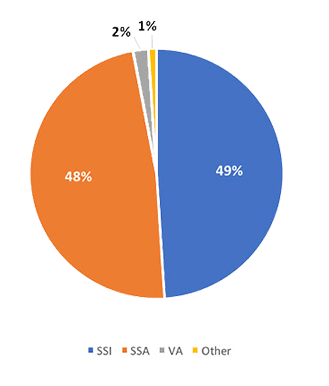

3. Benefits Distribution

All federal benefits are available through Direct Express® (see A Growing Program). 49% of cardholders receive Supplemental Security Income (SSI) with Social Security Retirement (SSA) benefits at almost the same level (48%). Veterans and other benefit payments comprise 3 percent of the total.

Fig 3. Benefits Distribution

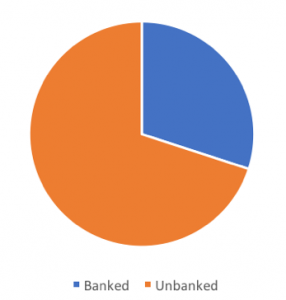

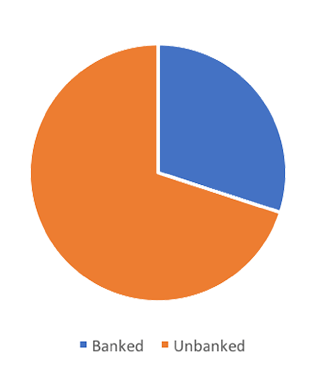

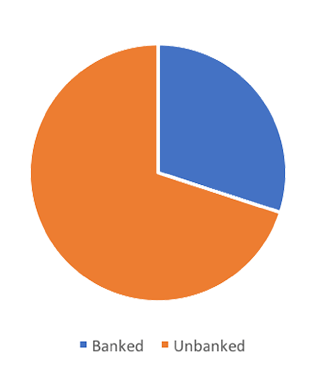

4. Unbanked Cardholders

70 percent of cardholders report that they do not have a bank account. The figure for the whole of the US population is 6.5 percent.

Fig 4. Unbanked Cardholders

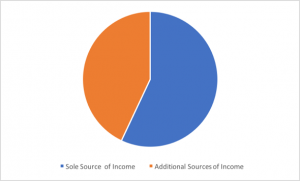

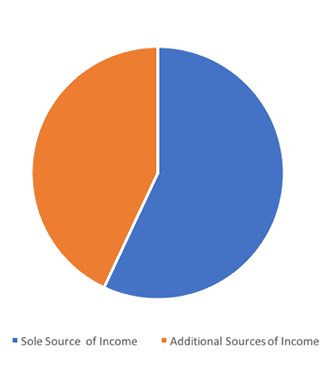

5. Income Sources

57 percent of Direct Express® cardholders report that the benefits they receive are their only source of income.

Fig 5. Income Sources

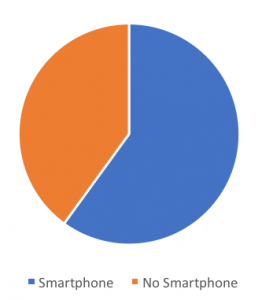

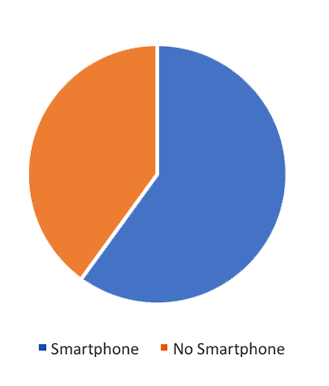

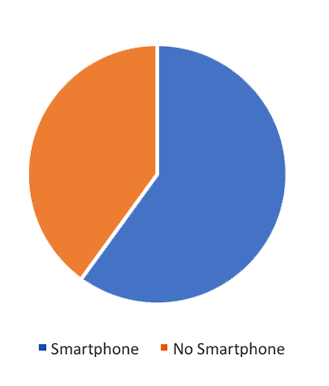

6. Smartphone Ownership

60 percent of Direct Express® cardholders own a smartphone. This figure compares with 77 percent of all Americans, according to 2018 study by the Pew Charitable Trusts. The number of cardholders with smartphones is expected to increase, and was a major driver in the development of the DX℠Mobile App.

Fig 6. Smartphone Ownership

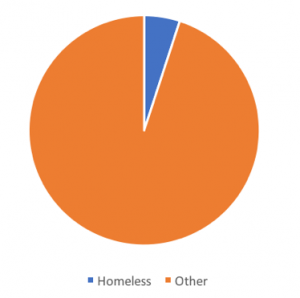

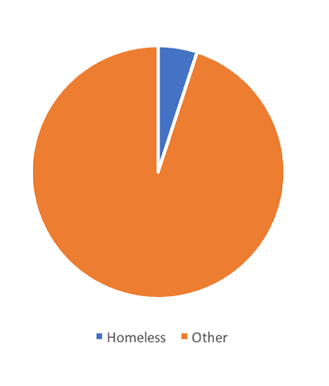

7. Homeless Cardholders

As reported in 2018 by the US Department of Housing and Urban Development’s Annual Homeless Assessment Report, 1.7 percent of the US population is considered homeless. As much as 5 percent of Direct Express® cardholders self-report that they are homeless.

Fig 7. Homeless Cardholders

SOURCE: Direct Express

As part of our annual survey of cardholders Direct Express® collects demographic and other information about who we serve, where they live and how they use their card. This data, which is aggregated and anonymized, is used to develop insights that can drive innovation and ensure that the Direct Express® card program is improved for the people that use it.

1. Cardholders by State

Direct Express® has cardholders in all 50 states, the District of Columbia and in major territories such as Puerto Rico. There are 4.5 million cardholders in total. The largest number of cardholders lives in California (379,000) and the fewest in the US Virgin Islands (325).

Fig. 1. Cardholders by State (in Thousands)

Fig 2. Cardholders by Age

2. Cardholders by Age

More than half of cardholders are over 50 years old, with only 7 percent under the age of 18.

2. Cardholders by Age

More than half of cardholders are over 50 years old, with only 7 percent under the age of 18.

Fig 2. Cardholders by Age

3. Benefits Distribution

All federal benefits are available through Direct Express® (see A Growing Program). 49% of cardholders receive Supplemental Security Income (SSI) with Social Security Retirement (SSA) benefits at almost the same level (48%). Veterans and other benefit payments comprise 3 percent of the total.

Fig 3. Benefits Distribution

Fig 4. Unbanked Cardholders

4. Unbanked Cardholders

70 percent of cardholders report that they do not have a bank account. The figure for the whole of the US population is 6.5 percent.

4. Unbanked Cardholders

70 percent of cardholders report that they do not have a bank account. The figure for the whole of the US population is 6.5 percent.

Fig 4. Unbanked Cardholders

5. Income Sources

57 percent of Direct Express® cardholders report that the benefits they receive are their only source of income.

Fig 5. Income Sources

Fig 6. Smartphone Ownership

6. Smartphone Ownership

60 percent of Direct Express® cardholders own a smartphone. This figure compares with 77 percent of all Americans, according to 2018 study by the Pew Charitable Trusts. The number of cardholders with smartphones is expected to increase, and was a major driver in the development of the DX℠Mobile App.

6. Smartphone Ownership

60 percent of Direct Express® cardholders own a smartphone. This figure compares with 77 percent of all Americans, according to 2018 study by the Pew Charitable Trusts. The number of cardholders with smartphones is expected to increase, and was a major driver in the development of the DX℠Mobile App.

Fig 6. Smartphone Ownership

7. Homeless Cardholders

As reported in 2018 by the US Department of Housing and Urban Development’s Annual Homeless Assessment Report, 1.7 percent of the US population is considered homeless. As much as 5 percent of Direct Express® cardholders self-report that they are homeless.

Fig 7. Homeless Cardholders